Choosing the right payment solution can have a significant impact on a business’s customer experience, a key factor in securing sales.

Among the numerous options available, Stripe and Clover are particularly noteworthy. Stripe offers sound financial management solutions that serve businesses globally, making it a favored choice for online transactions. On the other hand, Clover provides comprehensive point-of-sale (POS) solutions, tailored predominantly for physical storefronts.

The decision to choose between these platforms involves various factors, including the specific features they offer, their integration capabilities, and the costs associated with their use. Understanding these fine points is key to selecting the best payment processor for your business needs.

This article explores the functionalities and benefits of both Stripe and Clover. Additionally, we introduce a third option that could potentially align even more closely with the needs of omnichannel retailers looking for versatile, cost-effective solutions.

Let’s begin this comparison to empower you with the insight needed to select the ideal payment platform for your business.

Breaking down the business benefits: Stripe vs. Clover

Both Stripe and Clover cater to distinct business needs, making them outstanding choices depending on the specific requirements of your business. Here, we’ll explore the key features, payment processing capabilities, ease of use, and the associated costs of both Stripe and Clover, providing a detailed comparison to help you make an informed decision.

1. Key features

Let’s begin by exploring the primary features of both platforms:

Stripe:

Stripe acts as a comprehensive financial platform for businesses across the globe. It is utilized by millions of companies, ranging from startups to established enterprises, helping them to optimize their financial operations.

Here are some of its flagship features:

- Payment processing: Stripe offers robust solutions for both online and in-person payments, accommodating a wide range of payment methods.

- Billing and invoicing: With Stripe, businesses can automate their billing processes with flexible billing models that fit various pricing strategies.

- Security: Stripe is equipped with Stripe Radar, a premier technology for fraud detection and prevention, ensuring transactions are secure and trustworthy.

- Financial reporting: The platform provides detailed financial reporting & analytics that help businesses track and manage their finances effectively, offering insights that drive better decision-making.

Clover:

Designed primarily for in-store operations, Clover is an all-encompassing point-of-sale (POS) system that combines payment processing with extensive store management tools. It is a popular choice for retail and food service businesses that require a strong, integrated system for day-to-day operations.

Here are some of Clover’s key features:

- Payment processing: Clover excels in processing in-person payments and provides options for integrating online payment solutions for eCommerce, making it suitable for businesses with both physical and online stores.

- Proprietary hardware: Clover offers a range of custom hardware solutions, from mobile POS devices to full-service stations, catering to businesses of all sizes.

- Store management tools: Integrated directly into the POS system, features such as inventory management, customer relationship management, and comprehensive reporting tools streamline operations and enhance business efficiency.

2. Payment processing capabilities

Both Stripe and Clover offer powerful payment processing solutions tailored to different business models and needs. Let’s find out how each system is equipped to handle payments, both online and in person, providing a detailed look at their capabilities in facilitating smooth transaction processes for business.

Stripe:

Stripe is highly popular for its superior online payment capabilities. It supports over 100 different payment methods, including major credit cards, digital wallets, and even localized payment options, making it an ideal choice for global businesses.

Key features include:

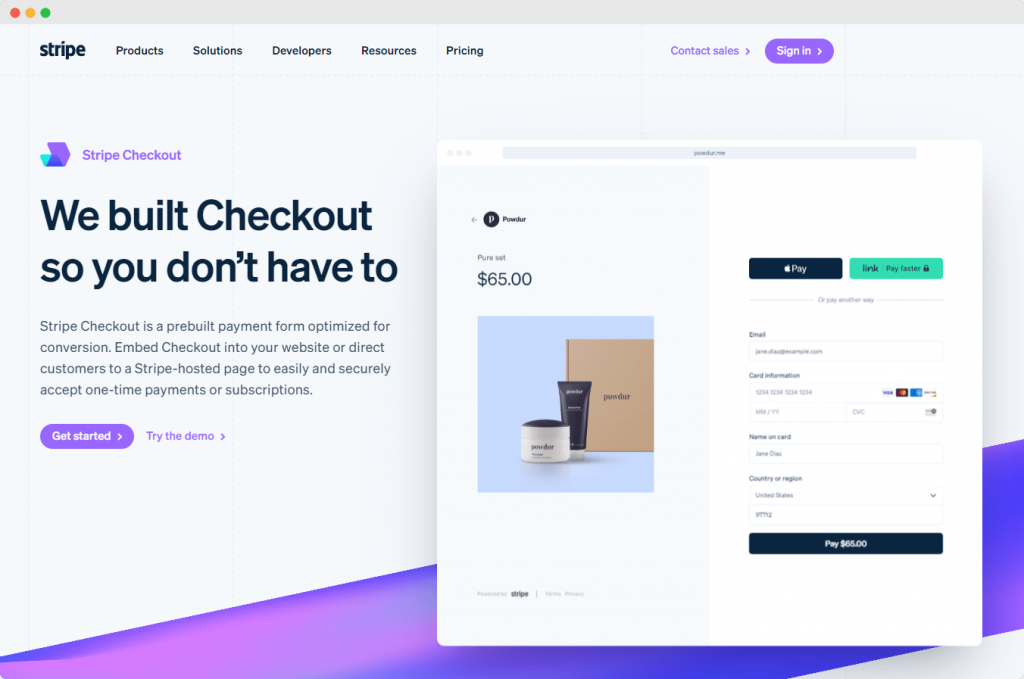

- Optimized checkout experience: Stripe simplifies the checkout process, offering features like one-click payments and pre-built payment interfaces that can be integrated directly into websites and mobile apps. This enhances the user experience and potentially increases conversion rates.

- eCommerce integration: Stripe seamlessly integrates with eCommerce platforms such as Shopify, WooCommerce, and Magento, among others. This versatility makes it an excellent choice for online and omnichannel merchants, adapting easily to various digital commerce setups.

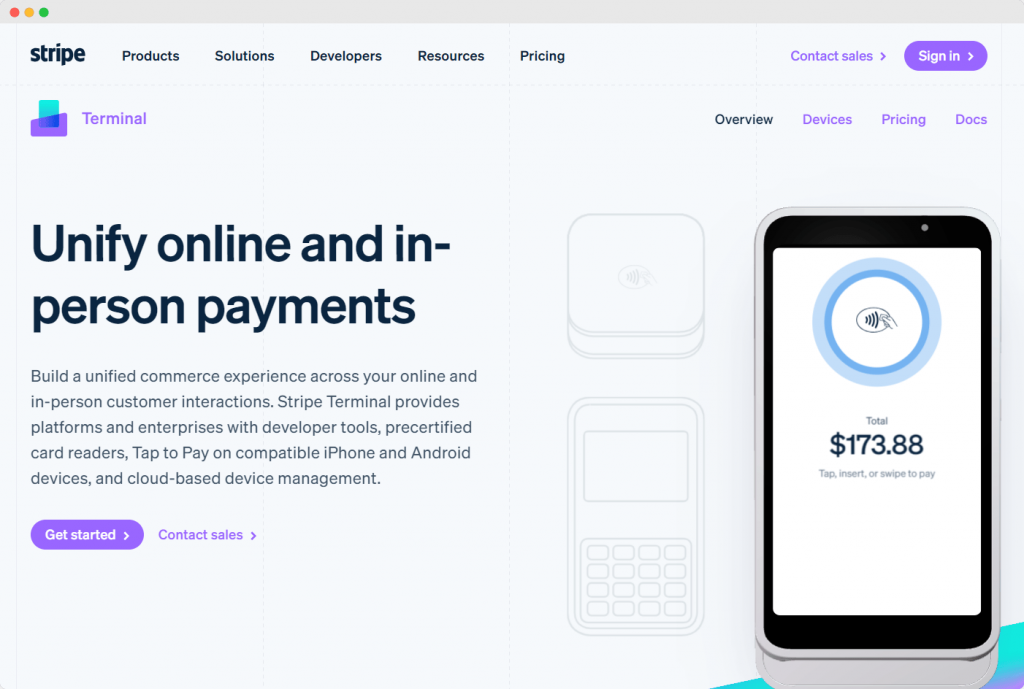

- In-person payments: Though predominantly known for online transactions, Stripe also caters to physical stores with Stripe Terminal. This solution allows businesses to accept in-person payments using a variety of hardware options, including Stripe’s proprietary devices and tap-to-pay features on compatible smartphones.

Clover:

While Stripe excels in the online domain, Clover’s strength lies in its in-person payment solutions. Designed primarily for physical retail and hospitality industries, Clover offers:

- Proprietary hardware: Clover provides a range of hardware options tailored to different business needs, from portable card readers for mobile or small retail setups to more robust terminal systems for high-volume businesses.

- Online payment support: In addition to its strong in-store payment solutions, Clover also facilitates online sales. Through its integration capabilities, businesses can extend their sales channels to include eCommerce websites, social media platforms, and even remote selling via phone or email.

3. Ease of use

The ease with which businesses can integrate and utilize payment processing systems plays an important role in their decision-making process. Both Stripe and Clover offer user-friendly interfaces and straightforward integration capabilities, but they cater to different operational needs. Let’s check out how each platform ensures a seamless experience for both merchants and customers.

Stripe:

Stripe is renowned for its emphasis on ease of use and customer convenience. The platform is engineered to simplify the payment process, making it as intuitive as possible.

- Streamlined checkout: Stripe’s one-click checkout and tokenization feature, which allows customers to securely save their payment details on Stripe’s secure servers for future use, exemplifies its commitment to a frictionless user experience. This speeds up the transaction process and enhances customer satisfaction by minimizing the effort required to make a purchase.

- Versatile integration: Regardless of the eCommerce platform, accounting software, or CRM system you use, Stripe can seamlessly integrate into your existing setup. This flexibility is a significant advantage for businesses looking to maintain and enhance their operational workflows without the need for extensive modifications.

Clover:

Clover, on the other hand, excels in physical sales with its highly customizable and easy-to-use POS systems for both customers and merchants.

- Out-of-the-box functionality: Clover devices are designed for immediate use upon setup, featuring an intuitive interface that requires minimal training. The customization options available directly on the devices allow merchants to tailor their POS system to include various functionalities such as payment processing, inventory management, and employee tracking.

- Focused integration: As Clover provides a solution for in-person transactions, it also supports a range of integrations that enhance its utility in a physical retail environment. These integrations are designed to complement the in-store experience, though they may be more limited in scope compared to Stripe’s extensive digital-first integrations.

4. Fees and charges

When choosing a payment platform, understanding the associated fees and charges is essential. Both Stripe and Clover employ different pricing models, each with its own set of benefits and considerations. Here’s a detailed breakdown of how each platform structures its fees:

Stripe:

Stripe simplifies its pricing with a straightforward, pay-as-you-go model. There are no startup costs or monthly fees; instead, merchants pay per transaction.

- Standard online transactions: Stripe charges a flat rate of 2.9% + $0.30 for each transaction. This fee applies to most card payments processed through the platform.

- Additional fees: For transactions involving manually entered cards, international cards, and currency conversions, additional fees apply. These can vary, so it’s advisable to consult Stripe’s transparent pricing page for a detailed list.

- In-person payments: The setup for Stripe Terminal, Stripe’s in-person payment solution, is free, but merchants must purchase the necessary hardware. In the U.S., the Stripe Reader M2 costs approximately $60, and internationally, the BBPOS WisePad 3 is available at a similar price point.

Clover:

Clover offers a more tiered pricing structure, potentially allowing for lower transaction fees depending on the chosen plan. Based on your plan, Clover may provide transaction fees marginally lower than Stripe’s, potentially as low as 2.3% + $0.10 per transaction.

- Basic plan: The most basic Clover plan includes a transaction fee of 2.6% + $0.10, with no monthly cost. This plan covers payment processing, reporting, and invoicing.

- Advanced plans: More comprehensive features like inventory and order management require opting for paid monthly plans, starting at $14.95/month. To access the lowest transaction fees, you must subscribe to the premium plan, which costs $49.95 per month.

- Hardware costs: All Clover plans require the purchase or rental of Clover hardware. For example, the Clover Flex handheld card reader can be rented for $35/month per reader for the first 36 months or purchased outright for $599.

Jovvie: Your gateway to seamless payment processing

While Stripe and Clover each offer robust payment processing solutions, they come with their own sets of strengths and limitations. Clover provides an excellent in-person point-of-sale (POS) system, which is ideal for physical retail settings, but it lacks flexibility in eCommerce integration and demands higher costs to access advanced features.

Conversely, Stripe excels in online payment processing, offering cost-effective and scalable solutions for digital transactions but falls short in comprehensive in-store management functionalities.

Introducing Jovvie, a dynamic solution that promises the best of both worlds for omnichannel retailers. Jovvie combines potent payment processing capabilities for both online and in-person sales with a broad feature set tailored for seamless store and customer management. This makes it an ideal choice for businesses looking to maximize efficiency across multiple sales channels.

Key features of Jovvie:

- Flexible payment processing: Jovvie integrates seamlessly with Stripe Terminal, allowing businesses to utilize Stripe’s flexible payment options with no additional transaction fees. For those who prefer different setups, Jovvie also supports Ingenico smart cards, external card reader terminals, and any payment gateway compatible with WooCommerce.

- Seamless eCommerce integration: Designed originally for WooCommerce users, Jovvie offers tight integration with the world’s leading eCommerce platform. For those not using WordPress or WooCommerce, Jovvie provides solutions including a cloud-hosted POS and an all-in-one POS system, ensuring comprehensive service regardless of the user’s existing platforms.

- Sell anywhere, on any hardware: Jovvie is compatible with a wide range of devices, including laptops, Android, and iOS devices, enabling businesses to avoid expensive hardware investments. This versatility allows for sales activities online, in-store, and on-the-go, making it an excellent option for businesses that operate in multiple locations or frequently sell at pop-up stalls or events.

- Infinitely scalable: One of Jovvie’s distinguishing features is its scalability. The system supports an unlimited number of devices, cashiers, and locations from the get-go, aiding businesses in expanding without incurring prohibitive costs.

- Powerful inventory management: Jovvie ensures that all inventory adjustments are automatically synchronized across all sales channels. This real-time integration helps omnichannel retailers manage their stock levels efficiently, avoiding discrepancies between online and physical store inventories.

Comparative overview:

To illustrate how Jovvie stands alongside Stripe and Clover, here’s a comparison table that encapsulates the key features, payment processing capabilities, ease of use, and fees of each solution:

| Solution | Key Features | Payment Processing Capabilities | Ease of Use | Fees & Charges |

|---|---|---|---|---|

| Stripe | Online-focused, extensive integrations, secure transactions. | 100+ payment methods, optimized for online use. | Highly user-friendly, flexible integrations. | 2.9% + $0.30 per transaction, additional fees for specific services. |

| Clover | Comprehensive POS, in-person optimized, customizable hardware. | Strong in-person processing, online payment support. | Intuitive out-of-the-box setup. | 2.6% + $0.10 upwards, monthly fees for advanced features. |

| Jovvie | Omnichannel support, flexible hardware options, powerful inventory management. | Integrates with Stripe Terminal, supports multiple gateways. | Designed for ease across platforms. | Competitive, based on chosen integrations. The basic monthly plan starts at $19 and includes a free trial. |

From transaction to satisfaction: Picking the perfect platform

Choosing the right payment platform helps simplify transactions and enhance customer satisfaction, ultimately ensuring more sales. Stripe and Clover, two leaders in the field, both offer unique benefits tailored to specific business environments, whether online or in-store. However, every business has distinct needs, and the choice of a payment platform should be based on those requirements.

Given the strengths and limitations of both Stripe and Clover, it’s clear that neither solution fits all use cases. This is where Jovvie stands out. With the best aspects of both platforms, Jovvie offers the user-friendly, efficient online payment processing capabilities of Stripe and combines them with the comprehensive in-person store management features of Clover. Moreover, Jovvie achieves this without burdening businesses with hidden fees or complex setup requirements.

If you’re looking for a solution that supports seamless transactions both online and in-store without compromise, consider Jovvie. Experience firsthand how Jovvie can simplify your operations and enhance customer interactions today with a free trial.