The security of online transactions has never been more critical than now in the rapidly expanding digital marketplace. Stripe is a leading payment facilitator, empowering businesses of all sizes across the globe to effortlessly manage payments, automate financial operations, and much more.

With its comprehensive suite of tools, Stripe simplifies the payment process for any eCommerce store or business looking to thrive online. However, amidst the convenience, the looming question of security remains paramount. As businesses entrust their financial transactions to platforms like Stripe, understanding the platform’s security capabilities is essential.

This article sheds light on Stripe’s built-in security features, comparing these with other popular payment processors and illustrating how integrating Stripe with a recommended Point-of-Sale (POS) system, like Jovvie, can enhance your business’s security and efficiency. Through this in-depth overview, we seek to answer the pivotal question, “How safe is Stripe for your business?” ensuring you make an informed decision for your online payment needs.

Unveiling Stripe’s security protocols for your business

Stripe offers an array of security measures designed to fortify business transactions against potential threats and fraud.

This commitment to security is evident in the comprehensive safeguards it employs, such as advanced encryption methods, safe data storage practices, and real-time fraud detection algorithms that work tirelessly to protect your transactions.

Additionally, Stripe’s compliance with PCI DSS (Payment Card Industry Data Security Standard) ensures that your business’s and customers’ data remain secure throughout every transaction.

These measures and more create a foundation of trust with customers by guaranteeing their sensitive information is handled with the utmost care and security, keeping businesses safe in the digital domain.

Let’s understand each of Stripe’s security features in detail.

1. Encryption and tokenization

At the heart of Stripe’s security measures are encryption and tokenization. These technologies are pivotal in protecting sensitive data, such as customer information and credit card details.

Stripe employs Transport Layer Security (TLS) to ensure that all data transmitted between servers is encrypted, safeguarding it from interception by unauthorized parties. Moreover, Stripe’s tokenization process replaces sensitive credit card data with unique identifiers or tokens. This means merchants do not store actual credit card details on their servers, significantly reducing the risk of data breaches.

This approach enhances security and streamlines the checkout process for returning customers, striking a balance between convenience and safety.

2. PCI DSS compliance

Stripe’s adherence to the highest level of PCI DSS compliance underscores its commitment to maintaining robust security standards. As a PCI Service Provider Level 1, Stripe meets the stringent requirements set by major credit card companies like Visa, Mastercard, and American Express, ensuring a secure environment for all credit card transactions.

This compliance serves as proof of Stripe’s commitment to maintaining the highest security standards, assuring businesses that their transactions are handled securely.

3. Stripe Radar

Fraudulent activities pose a significant threat to online transactions. Stripe Radar, an advanced fraud detection system, is an optional add-on feature that businesses using Stripe can adopt. It leverages machine learning to analyze and block fraudulent transactions. By scrutinizing each transaction and providing real-time fraud protection, Stripe Radar minimizes the risk of fraud, safeguarding businesses from potential financial losses.

This proactive approach to fraud prevention is the foundation of Stripe’s security measures, ensuring businesses can operate safely.

4. Two-Factor authentication

Two-factor authentication (2FA) adds a layer of security to Stripe accounts, mitigating the risk of unauthorized access. By requiring a second form of verification beyond just the password, 2FA ensures that only authorized users can access the account.

Stripe also supports single sign-on (SSO) through Security Assertion Markup Language (SAML) 2.0, which further enhances access control. It allows for detailed user role assignments to restrict access based on specific roles or privileges.

This multifaceted approach to account security is critical in safeguarding against unauthorized access and potential breaches.

5. Account protection

Stripe’s account protection features, including verification emails and account activity monitoring, play a crucial role in preventing unauthorized access or changes to accounts. Moreover, the option for businesses to set up Federal Deposit Insurance Corporation (FDIC) insured accounts provides an additional safety net, offering protection up to $250,000.

This comprehensive approach to account protection ensures that businesses have the tools and safeguards in place to protect their operations from unauthorized activities.

6. Privacy and data protection

Stripe’s commitment to privacy and data protection is evident in its compliance with major regulations like the GDPR in Europe. Stripe’s evolving privacy policies and practices aim to protect customers’ personal data, adhering to the highest standards of data protection

By aligning with these regulations, Stripe safeguards customer data and also builds trust, emphasizing its role as a secure platform for processing transactions. For more information on Stripe’s commitment to privacy and data protection, check out Stripe’s comprehensive Privacy Policy.

Comparing Stripe with other top payment processors

When it comes to selecting a payment processor for your business, a thorough understanding of available options is crucial. Stripe, PayPal, and Square represent three of the most prominent players in the payment processing sphere, each offering unique features and benefits. However, to determine which is the safest and most efficient choice for your business, a comparison on the grounds of security, ease of use, customer service, and cost is essential.

Security

- Stripe implements rigorous security measures, including encryption, tokenization, and compliance with PCI DSS Level 1 standards. Its advanced fraud detection system, Stripe Radar, uses machine learning to identify and block fraudulent transactions.

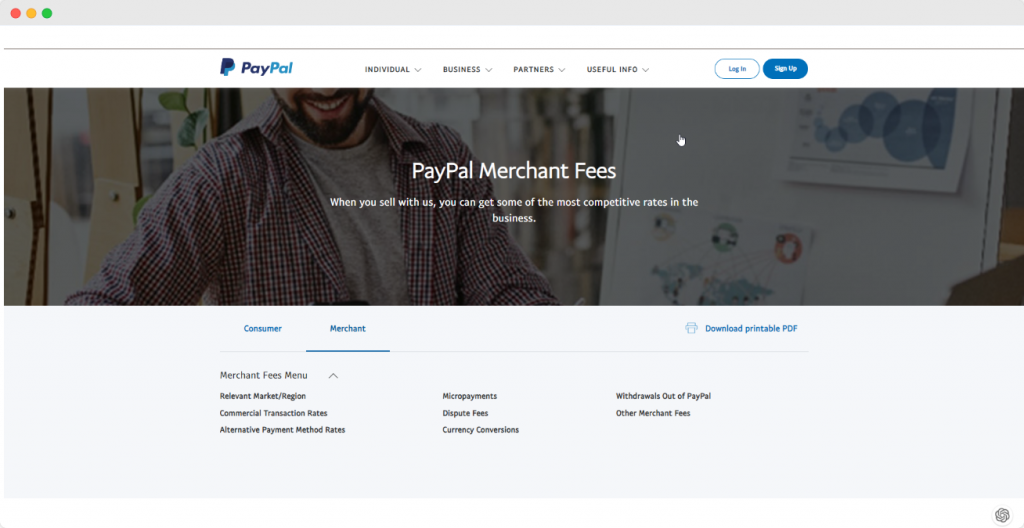

- PayPal also offers robust security features, such as end-to-end encryption and fraud protection. PayPal’s long-standing reputation in the market is backed by a history of secure transactions and adherence to PCI compliance.

- Square prioritizes security with encryption, tokenization, and compliance with PCI standards. Square’s security measures are designed to protect both online and offline transactions, reflecting its dual focus on eCommerce and physical retail.

Ease of use

- Stripe is renowned for its developer-friendly API and comprehensive documentation, making it easy for businesses to integrate Stripe into their systems. Its user interface is intuitive, catering to both tech-savvy users and those with less technical expertise.

- PayPal offers a straightforward setup and is widely recognized, which can reduce friction for customers familiar with the PayPal checkout experience. However, its API and customization options might not be as extensive as Stripe’s.

- Square excels in ease of use, especially for physical retail businesses. Its POS system and seamless integration with various eCommerce platforms make it a versatile option for businesses of all sizes.

Customer service

- Stripe provides detailed online resources and email support, but some users may find its lack of immediate phone support challenging for urgent issues.

- PayPal has a broad customer service network, offering phone, email, and chat support. However, users sometimes report long wait times and mixed experiences with the resolution of disputes.

- Square is known for its accessible customer service, including phone support, online resources, and a community forum. Square’s hands-on approach is particularly beneficial for small businesses requiring quick assistance.

Cost

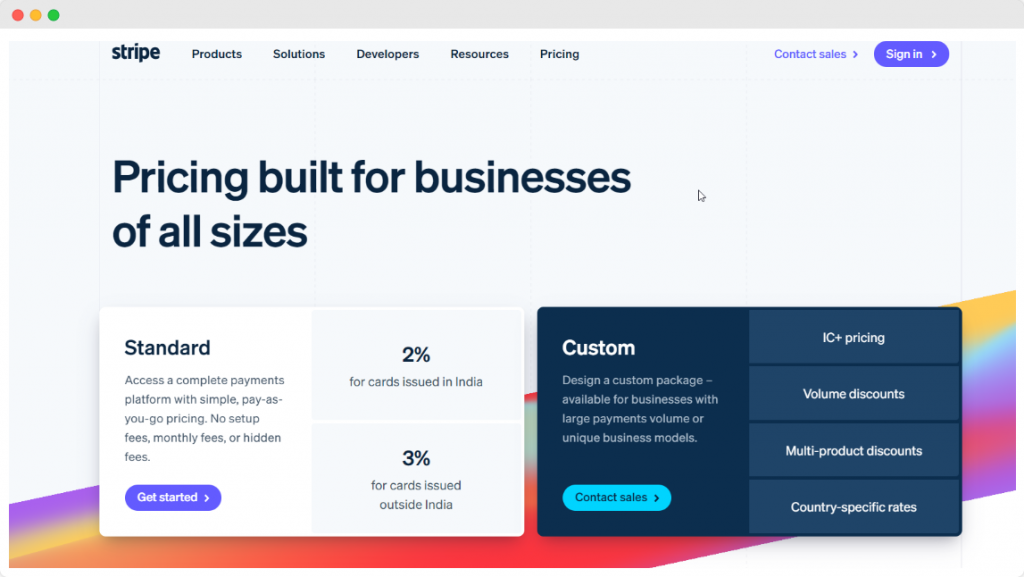

- Stripe provides a transparent pay-as-you-go pricing model for online transactions, suitable for businesses of all sizes without any setup, monthly, or hidden fees. Additionally, it offers advanced features such as Radar for fraud prevention and custom options for businesses with large volume transactions or unique models.

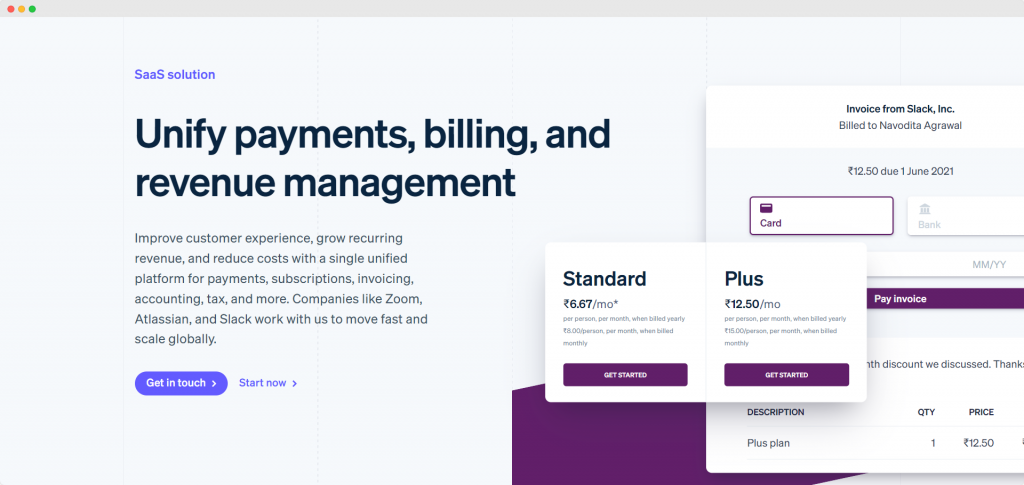

- PayPal positions itself as a competitive option for merchants, promising some of the best rates in the business. It offers a structured menu of merchant fees, including commercial transaction rates and micropayments, as well as charges for dispute resolution, currency conversions, and withdrawals. PayPal charges per transaction and includes a fixed fee on top of the percentage cut. For businesses, the familiarity of PayPal can be a double-edged sword, balancing higher fees with customer trust.

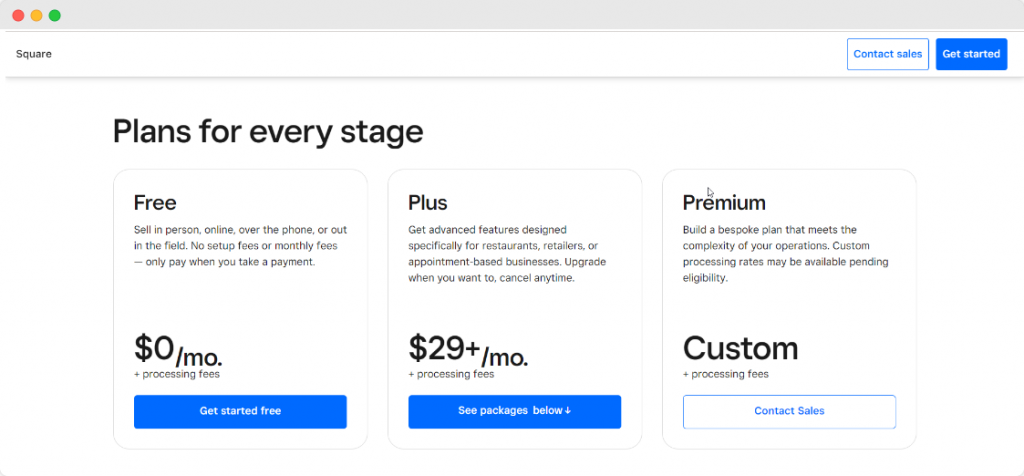

- Square offers straightforward pricing for swipe transactions but may include higher costs for keyed-in transactions and advanced features. It offers a tiered pricing strategy to accommodate every stage of business growth, starting with a $0 per month Free plan that allows merchants to sell in various ways and charges only processing fees. For businesses seeking advanced features, there’s a Plus plan at $29 per month, and for those needing tailored solutions, a Custom plan is available, with the possibility of custom processing rates.

Note: Cost comparison among these platforms varies based on transaction types, volume, and additional services.

Here’s a simplified overview of our comparison between Stripe, PayPal, and Square:

| Platform | Security | Ease of use | Customer service | Cost |

| Stripe | Excellent | Excellent | Good | Variable fees per transaction, no hidden charges. |

| PayPal | Excellent | Good | Good | Transaction fees plus fixed fee, subscription options. |

| Square | Excellent | Excellent | Excellent | Fixed per transaction fee, additional fees for premium features. |

Maximizing Stripe for your business with Jovvie’s integration

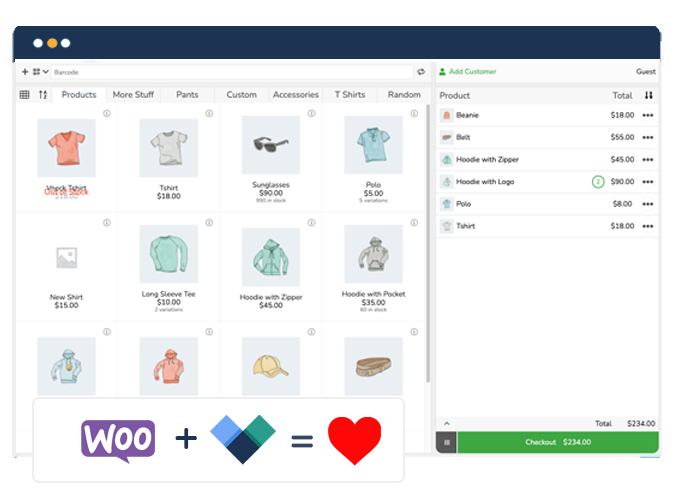

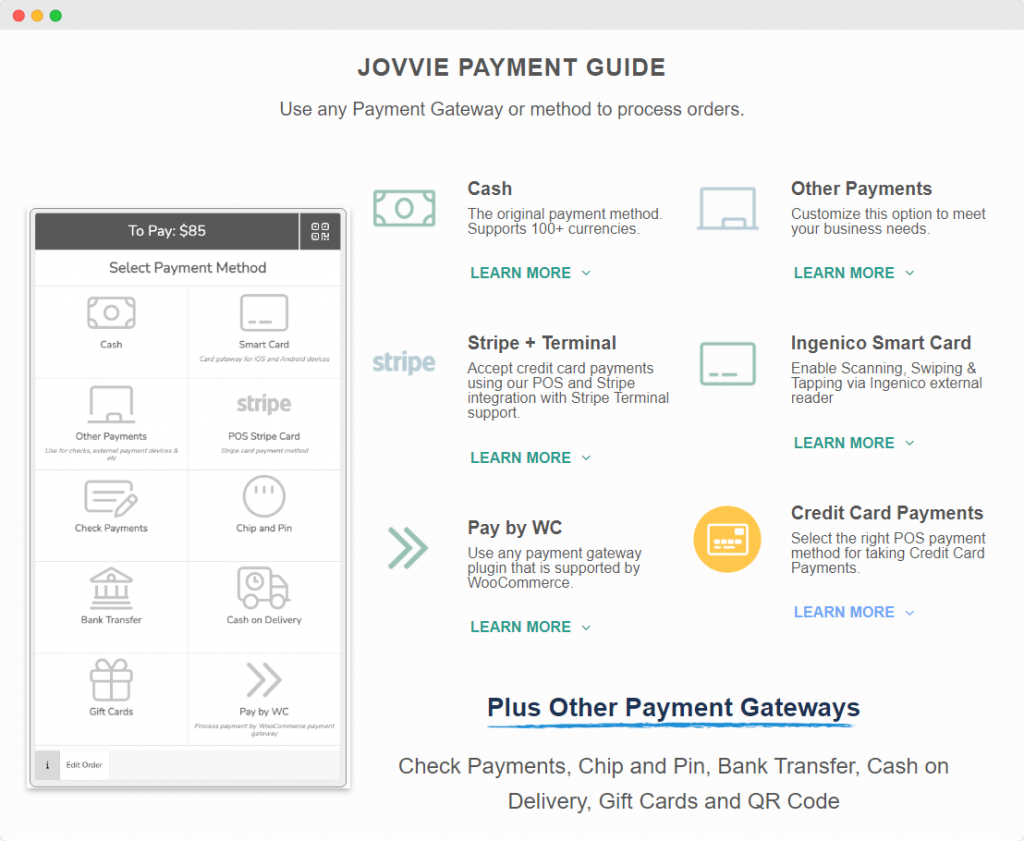

For omnichannel eCommerce store operators, leveraging Stripe for payment processing is a step toward secure, seamless transactions. However, to fully harness the potential of Stripe in a brick-and-mortar setting, a complementary Point-of-Sale (POS) system is indispensable.

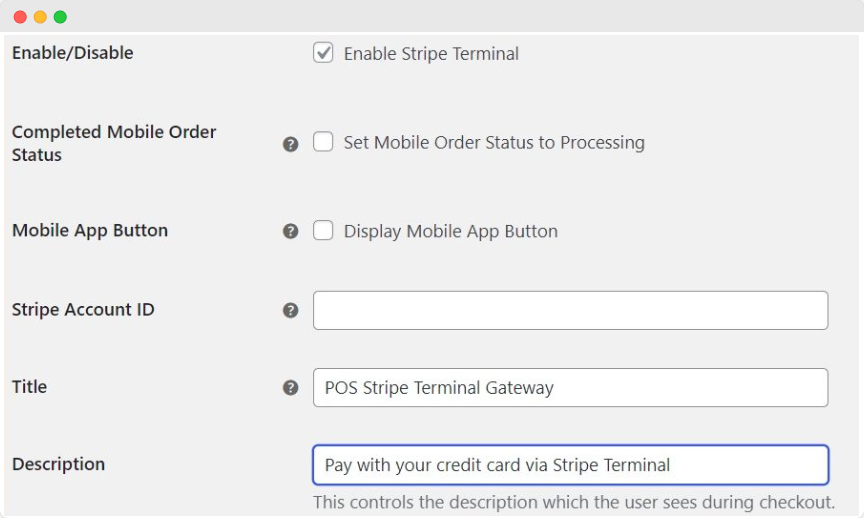

While Stripe’s own in-person payment solution, Stripe Terminal, facilitates physical transactions, it may not offer the flexibility and comprehensive features that a specialized POS system like Jovvie provides.

Jovvie enhances the utility of Stripe by providing a robust platform for omnichannel store owners. It offers key features like synchronized inventory between online and in-person sales, ensuring that your sales are always in harmony, regardless of whether you make them online, in-store, or on-the-go. This synchronization streamlines operations and minimizes the risk of stock discrepancies and sales errors.

Additionally, Jovvie’s customer management and analytics capabilities offer insights into purchasing behaviors, helping businesses tailor their offerings more effectively. Another important feature is the versatility to operate on any device – be it a tablet, computer, iPhone, or Android device.

For businesses interested in leveraging Stripe’s security for their in-person transactions while benefiting from the comprehensive features of a dedicated POS system, integrating Stripe Terminal with Jovvie offers a compelling solution.

To explore this integration further and understand how it can benefit your business, visit our complete guide on integrating Stripe Terminal with Jovvie. This guide provides detailed insights into making the most of Stripe’s security features in a physical retail setting, ensuring your business is equipped to offer secure, efficient, and customer-friendly transactions both online and offline.

Take the next step towards secure transactions with Stripe and Jovvie

Transaction security is crucial for businesses of every type and size. Stripe offers a suite of security measures designed to safeguard transactions and build customer trust. But the journey towards comprehensive transaction security doesn’t end with online payments.

Integrating Stripe with Jovvie for your omnichannel store ensures that the same level of security is extended to in-person sales, providing a seamless and secure shopping experience across all platforms.

Whether your transactions are conducted online, in-store, or on the go, the combination of Stripe and Jovvie offers an unparalleled solution. With Jovvie, businesses gain a POS system and a comprehensive retail management tool that complements Stripe’s secure payment processing capabilities.

Take the next step towards secure, streamlined transactions by exploring the integration of Stripe and Jovvie. Discover the benefits and see how this powerful duo can elevate your business operations and customer satisfaction.

Get started with Jovvie today to begin your journey toward a more secure, efficient, and customer-centric transaction process.