Stripe is one of the leading payment service providers on the market, powering transactions for global giants like Amazon, Uber, and Airbnb.

In fact, over four million websites use Stripe for payment processing. And it’s easy to see why: Stripe offers support for over 100 payment methods, an optimized customer checkout experience, and great integration capabilities.

But is Stripe the all-in-one solution for every online business’s financial management needs? Probably not. As versatile as Stripe is, some store owners might need more customized solutions to manage various aspects of their eCommerce strategy. For example, businesses with high-volume sales or large inventories may benefit from alternatives that offer advanced inventory management and powerful integration capabilities.

If this sounds like something you’ve been hunting for, keep reading! This article will introduce you to some of the top Stripe alternatives and help you find the perfect fit for your business needs.

Exploring top alternatives to Stripe for your business

1. Jovvie

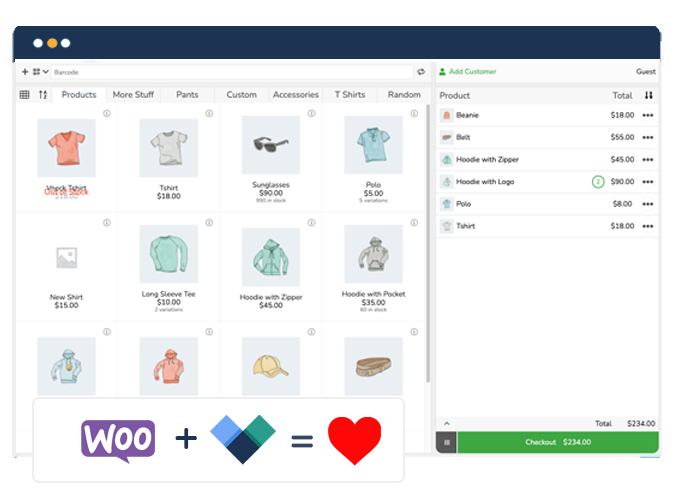

Jovvie by BizSwoop is a user-friendly WooCommerce Point of Sale (POS) system. It offers comprehensive payment options, including integration with Stripe and other WooCommerce-compatible payment gateways.

With Jovvie, you can benefit from all of Stripe’s core features while also having access to features that make managing an omnichannel store easier, such as inventory management, customer management, and the ability to use your own hardware. Additionally, Jovvie is great for those who specifically want a Stripe alternative, as it works with any WooCommerce-supported payment gateway besides Stripe.

Key features:

- Flexible payment processing: As an official Stripe partner, Jovvie integrates with Stripe Terminal, allowing businesses to use Stripe’s flexible payment options with no additional transaction fees. Jovvie also supports other payment options, including cash, Ingenico Smart Card, external credit card reader terminals, and any payment gateway compatible with WooCommerce.

- Sell on any device: Jovvie doesn’t require custom hardware and is compatible with many devices, including laptops, Android, and iOS devices. This flexibility allows for sales activities online, in-store, and on the go, making it ideal for businesses with multiple locations or pop-up events.

- Simple integration: Jovvie’s integration with WooCommerce is a significant advantage for store owners who want to expand their sales channels. This means that you can easily set up and manage your in-person sales without worrying about additional setup steps. And, if you’re not using WordPress or WooCommerce, Jovvie offers flexible options, including a cloud-hosted POS and an all-in-one POS system, ensuring that you can use it regardless of your existing platform.

- Live inventory management: Thanks to Jovvie’s real-time inventory management, you never lose sight of your website and in-stock inventory. By integrating with WooCommerce at multiple key stages, Jovvie keeps track of product data, including Stock Keeping Units (SKU), descriptions, and images, so your inventory levels are always up-to-date and accurate.

Pricing:

Starting at $19 per month, Jovvie is a cost-effective yet high-value option for businesses looking to enhance their payment processing capabilities without incurring significant expenses. As an added bonus, you can explore the platform with a 30-day free trial to make sure it’s right for you. But rest assured, if you’re looking for a payment processing solution that’s flexible, easy to use, and offers complete customer management, you’ll be glad you chose Jovvie.

2. Square

Square is a popular payment processing and POS system ideal for small to mid-sized businesses looking for an affordable and easy-to-use solution. The platform allows you to accept payments in person, online, and on the go through its mobile app. It supports credit cards, Apple Pay, Google Pay, and more.

Key features:

- Retail business solutions: Square’s Retail POS system includes advanced functionalities, like vendor and purchase management, to help retailers run their businesses more efficiently. Like Jovvie, Square for Retail also integrates online sales with in-person transactions, providing a unified view of sales and inventory.

- Restaurant management tools: The Square for Restaurants POS system is designed for restaurants and includes table management, course management, discounts, inventory tracking, and detailed reporting to streamline restaurant operations.

- Convenient online store setup: Businesses can easily set up an online store with Square without monthly fees, which is ideal for small businesses.

Pricing:

Square charges 2.6% plus $0.10 per in-person transaction and 2.9% plus $0.30 per online transaction through the Square Online Store or eCommerce Application Programming Interface (API).

3. PayPal

PayPal is a widely used payment processing platform trusted by over 200 million merchants worldwide. It is ideal for businesses of all sizes seeking a reliable payment solution. PayPal supports various payment methods, including credit cards, Venmo, and more.

Key features:

- Seller protection: PayPal offers seller protection policies to safeguard your business transactions from chargebacks, reversals, and associated fees.

- Global accessibility: PayPal supports transactions in 25 currencies across 200 markets, so you can easily accept payments from international customers.

- One TouchTM: This feature allows customers to stay logged in and complete purchases without repeatedly entering their passwords. One TouchTM and its streamlined checkout process can enhance user experience and reduce cart abandonment rates.

Pricing:

PayPal’s fees vary based on the transaction type and the merchant’s location. For transactions made on PayPal’s website using credit and debit cards, PayPal charges 2.99% plus $0.49 per transaction. On the other hand, PayPal charges 3.49% plus $0.49 per transaction for payments made via online checkouts on merchant websites.

Transactions made on PayPal’s in-person point-of-sale (POS) system are charged at 2.29% of the transaction plus a $0.09 fee.

4. Shopify Payments

Shopify Payments is an integrated payment solution offered by Shopify for online businesses using their platform. It is best suited for eCommerce businesses looking for a convenient and reliable payment processing solution without needing third-party gateways.

However, its biggest drawback is that it can only be used within the Shopify ecosystem, limiting its usefulness for businesses that operate across multiple platforms or require a more flexible payment solution.

Key features:

- Unified platform: Thanks to its integration with Shopify’s eCommerce platform, Shopify Payments offers a unified system for managing orders, inventory, and payments in one place.

- Instant payouts: Businesses can benefit from quick access to their funds with instant payouts, enabling faster cash flow and improved financial management.

- Fraud analysis: Shopify Payments includes built-in fraud analysis tools that help businesses detect and prevent fraudulent transactions.

Pricing:

Shopify Payments charges transaction fees based on a business’s Shopify plan. For businesses on the Basic plan, the fee is 2.9% plus $0.30 per online transaction. The fee decreases for businesses on higher-tier plans like Shopify and Advanced.

5. Helcim

Helcim is a payment processor that offers in-person, mobile, and online payment solutions. It is best suited for small- to medium-sized businesses seeking an affordable, transparent, and user-friendly payment processing solution.

However, it’s worth noting that while Helcim can be used internationally, customers will only be able to purchase in Canadian Dollars (CAD) or United States Dollars (USD).

Key features:

- Online invoicing: With Helcim’s free invoicing software, businesses can create and send customizable invoices, accept online payments directly through the invoices, and store customer information securely.

- Diverse payment options: Helcim supports various payment methods, including credit and debit cards, Automated Clearing House (ACH) payments, Quick Response (QR) code payments, mobile wallets, and more.

- Subscription management: If you offer a subscription-based service, Helcim’s Subscription Manager will help you create automated plans. The best part is that you can see all your subscribers and plans in one dashboard.

Pricing:

Helcim’s tiered pricing structure is based on monthly transaction volume, which allows businesses to potentially reduce their payment processing expenses as they grow. It passes on the best available interchange fee and charges a nominal, transparent fee.

For in-person payments, rates start at 0.4% plus $0.08 per transaction but could go as low as 0.15% plus $0.06. Similarly, for online payments, rates start at 0.50% plus $0.25 per transaction and reach as low as 0.15% plus $0.15.

6. Adyen

Adyen is a global payments platform that provides a unified commerce solution for businesses to accept payments online, in-store, and on mobile devices. It is best suited for large, international enterprises and is trusted by brands such as LinkedIn, Spotify, and Wix.

Key features:

- Adaptive routing: Adyen’s intelligent payment routing system automatically selects the best payment method based on transaction value, customer location, and payment preferences.

- Fraud prevention: The platform offers advanced fraud prevention tools, including machine learning algorithms and real-time risk assessments, to protect businesses against fraudulent transactions.

- Issuing capabilities: Businesses can create physical or virtual payment cards with their own branding. These cards can be used to send funds to users or manage spending instantly. This feature is especially valuable for platforms and marketplaces that need to pay users quickly in their preferred currency.

Pricing:

For each transaction, Adyen charged a fixed processing fee of €0.11, along with additional fees based on the payment method used. For example, if a customer uses an American Express card, they’ll be charged €0.11 plus a 3.95% payment method fee.

7. Stax Payments

Stax Payments is a payment technology company offering a payment processing platform suited for small- to medium-sized enterprises looking for simplified and cost-effective payment solutions.

Key features:

- Next-day funding: Quick access to funds is essential for managing business operations efficiently, and Stax’s next-day funding provides rapid availability of processed payments.

- Flexible payment solutions: Stax Payments supports in-person payments through customizable smart terminals and mobile readers, as well as online payments with pre-built no-code hosted payment pages, payment links, and buttons.

- Advanced analytics: You can get detailed insights into your payment data using Stax Payments’ customizable reports and dashboards that help you track sales trends, customer behavior, and financial performance in real time.

Pricing:

Stax Payments offers a transparent pricing model starting at $99 per month, which adjusts based on your business’s processing volume. The plan has no extra markup on the basic interchange cost and helps save money by removing typical per-transaction fees.

Pricing levels are determined by how much you process each year, and businesses with higher volumes can get custom quotes for pricing that better fits their needs.

8. Authorize.net

Authorize.net is a payment gateway service provider designed to help businesses securely accept payments in person, online, and over the phone.

Key features:

- Advanced Fraud Detection Suite (AFDS): Authorize.net includes a customizable suite of fraud prevention tools and filters, like velocity filters, Internet Protocol (IP) filters, and shipping-billing mismatch alerts, to help businesses detect and prevent fraudulent transactions.

- Recurring billing: You can set up automated, scheduled payments for subscription services or installment plans to streamline your billing processes.

- Customer Information Manager (CIM): The CIM feature securely stores customer payment information, so your business can process future transactions without requiring customers to re-enter their data each time.

Pricing:

Authorize.net’s pricing structure includes a setup fee, a monthly gateway fee, and a per-transaction fee.

While specific pricing details may vary based on the business’s needs and transaction volume, Authorize.net typically charges a setup fee of around $25, a monthly gateway fee of approximately $25, and a per-transaction fee ranging from $0.10 to $0.30.

9. Clover

Clover is a POS system designed primarily for in-store operations. It offers a range of tools and services to streamline transactions, inventory management, and customer engagement.

Key features:

- Clover Capital: Businesses using Clover can access funding directly through the platform and apply for capital to invest in growth initiatives, such as purchasing inventory, expanding services, or addressing financial needs.

- App Market: Clover’s App Market offers various third-party integrations and applications. Businesses can customize their POS system by adding apps tailored to their needs, such as online ordering, loyalty programs, accounting software, and more.

- Insights and analytics: Get detailed sales data, customer behavior analysis, and inventory trends to make informed decisions.

Pricing:

Clover’s pricing structure varies based on the specific hardware and software needs of each business. The Clover Go plan, for example, starts at $39 per month, while the Clover Flex plan starts at $69 per month. Additionally, businesses can expect to pay a processing fee of around 2.3% plus $0.10 per transaction.

Start improving your payment systems with Jovvie today

While Stripe serves as a powerful payment processor for many online stores, those in search of a more feature-rich payment infrastructure might find it lacking in some areas.

As we’ve explored various solutions throughout this article, it’s clear that every option has its strengths and weaknesses. So, your choice should align with the specific demands of your business.

But we get it – change isn’t easy. So, if you find it daunting to switch from Stripe, consider Jovvie. Jovvie isn’t an alternative to Stripe, but rather an extension of Stripe’s impressive functionalities.

By using Jovvie, you can continue to enjoy the benefits of Stripe while accessing a more comprehensive POS system. And Jovvie stands out for several reasons:

- It offers mature inventory management capabilities, so you can manage your stock effectively.

- You can gain deeper insights into your customers’ behavior with built-in analytics that help you understand purchasing trends, track customer engagement, and more.

- You can easily integrate it with other tools and platforms you already use, whether it’s accounting software, Customer Relationship Management (CRM) systems, or eCommerce platforms.

Are you ready to reap the benefits of a more efficient payment process? Try out Jovvie today to see how you can upgrade your business operations!