WooCommerce is not PCI compliant by itself – the responsibility for PCI compliance lies with you as the store owner. While WooCommerce provides tools and features that support compliance, achieving and maintaining PCI compliance depends on how you handle payment data and which security measures you implement.

This guide explains exactly what you need to do to make your WooCommerce store PCI compliant. You’ll learn:

- The specific requirements your store needs to meet.

- How to choose and implement secure payment processing.

- Step-by-step technical security measures.

Documentation and ongoing maintenance requirements.

What is PCI compliance?

The Payment Card Industry Data Security Standard (PCI-DSS) sets requirements for businesses that handle credit card information. These standards protect customers’ payment data through specific security measures and best practices.

Why your WooCommerce store needs to be PCI compliant

Running a WooCommerce store that accepts credit card payments means you must meet PCI-DSS requirements. Compliance:

- Protects your customers’ payment information from theft.

- Prevents financial penalties from payment processors and banks.

- Helps avoid data breaches that could harm your business reputation.

- Maintains your ability to process credit card payments.

The level of compliance your store needs depends on how you handle payment data:

- Using third-party payment gateways like PayPal or Stripe reduces your compliance requirements.

- Storing credit card data on your servers requires the highest level of compliance.

- Your annual transaction volume determines specific security measures needed.

How to make your WooCommerce site PCI compliant

Making your WooCommerce store PCI compliant might seem complex, but breaking it down into clear steps makes it manageable. Let’s walk through exactly what you need to do, starting with understanding your store’s requirements.

Determine your PCI requirements

Your compliance requirements depend on your transaction volume over 12 months:

| Level | Annual transactions | Requirements |

| Level 1 | Over 6 million | Full assessment by Qualified Security Assessor (QSA) |

| Level 2 | 1-6 million | Self-assessment Questionnaire (SAQ) |

| Level 3 | 20,000-1 million | Self-assessment Questionnaire (SAQ) |

| Level 4 | Under 20,000 | Self-assessment Questionnaire (SAQ) |

Most WooCommerce stores fall into Level 4, requiring completion of an SAQ. The type of SAQ you need depends on how you process payments:

- SAQ A: For stores using only third-party processors (like PayPal).

- SAQ A-EP: For stores using integrated solutions (like Stripe).

- SAQ D: For stores that store card data directly.

Implement technical security measures

Your hosting environment forms the foundation of PCI compliance. Essential security measures include:

Secure hosting setup

- Choose a PCI-compliant hosting provider.

- Configure server-level firewalls.

- Enable automated malware scanning.

- Set up intrusion detection systems.

SSL/TLS encryption

- Install an SSL certificate.

- Force HTTPS across your entire site.

- Implement proper SSL certificate management.

- Ensure regular certificate renewal and updates.

Security monitoring

- Run regular security scans.

- Conduct automated vulnerability assessments.

- Implement system activity logging.

- Incorporate real-time threat detection.

Ensure account security & access control

Protecting your WooCommerce store requires strict control over who can access sensitive data:

User permissions

- Limit access to payment information based on job roles.

- Create specific user roles with minimum required permissions.

- Remove access immediately when staff members leave.

Authentication measures

- Implement two-factor authentication (2FA) for admin accounts.

- Enforce strong password policies.

- Require regular password updates for all users with admin access.

Set up payment processing security

Your choice of payment processing method affects your PCI compliance requirements:

Third-party payment gateways

PayPal and similar providers handle transactions on their secure platforms, reducing your compliance burden since payment data never touches your servers.

Integrated solutions

Payment processors like Stripe and WooPayments use tokenization to replace sensitive card data with secure tokens, offering a balance between security and convenience.

Custom payment solutions

If you’re storing card data on your servers:

- Implement end-to-end encryption

- Set up secure card storage systems

- Maintain comprehensive access logs

- Regular security audits are mandatory

Get familiar with documentation & ongoing compliance

PCI compliance isn’t a one-time task. You need:

Regular maintenance

- Quarterly network scans by approved vendors.

- Annual security assessments.

- Updated security policies.

- Continuous monitoring of system access.

Required documentation

- Complete Self-Assessment Questionnaire (SAQ).

- Maintain Attestation of Compliance (AOC).

- Document all security procedures.

- Keep incident response plans current.

Your next move: Ensuring and maintaining PCI compliance in your WooCommerce store

Creating a secure environment for your customers’ payment data requires ongoing attention to PCI compliance. Whether you choose a third-party payment gateway like Stripe or WooPayments or implement a custom solution, maintaining compliance protects both your customers and your business.

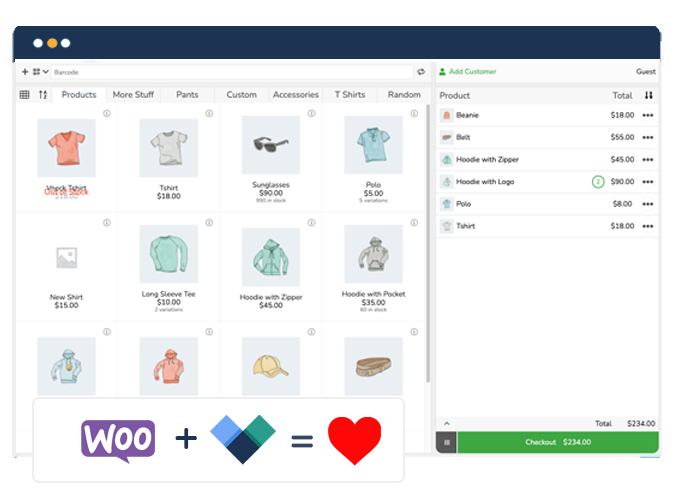

Jovvie supports multiple payment options for both online and in-person transactions. Our integration with services like Stripe helps ensure your store maintains PCI compliance while providing secure payment processing for your customers.

Ready to secure your WooCommerce store? Get started with Jovvie’s PCI-compliant payment processing solutions. Your customers trust you with their payment information – protect it with Jovvie.