Choosing between Woo Payments and Stripe is a crucial decision for your online store’s success. While both payment gateways offer robust features for WooCommerce stores, they have distinct differences in availability, pricing, and functionality that could significantly impact your business.

This comprehensive comparison breaks down exactly how WooCommerce Payments and Stripe stack up against each other. We’ll examine their costs, transaction speeds, geographic availability, supported currencies, and customer service – everything you need to make an informed choice for your store.

Woo Payments vs. Stripe: How to Choose

Here’s a detailed comparison of WooCommerce Payments and Stripe across key features:

| Feature | WooCommerce Payments | Stripe |

| Online Transaction Fees | 2.9% + $0.30 per transaction | 2.9% + $0.30 per transaction |

| In-Person Transaction Fees | 2.6% + $0.10 per transaction | 2.7% + $0.05 per transaction |

| International Fees | +1% for international transactions | +1% for international transactions |

| Geographic Availability | 18 countries | 47 countries |

| In-Person Payments | US and Canada only | Available in 8 countries |

| Currency Support | 135+ currencies | 135+ currencies |

| Fund Availability | 7 days for new accounts | 2 days for US accounts |

| Integration | Native WooCommerce integration | Via plugin |

| Hardware Costs | Variable by region | ~$60 for card reader |

Comparing costs and fees

Every transaction impacts your bottom line. Here’s exactly what you’ll pay with each platform:

Both charge 2.9% + $0.30 for online transactions, covering credit cards, debit cards, and digital wallets. For in-person sales, WooCommerce Payments edges ahead with 2.6% + $0.10 per transaction, while Stripe charges 2.7% + $0.05. Going international? Both add 1%, but Stripe offers better currency conversion rates.

Speed

Time is money in ecommerce. Both platforms process online payments instantly, but they differ in fund availability:

Transaction processing

- Both platforms process online transactions instantly

- Stripe typically has faster processing for in-person payments

- Both offer real-time payment verification

Fund availability

- WooCommerce Payments: 7-day holding period for new accounts, which may decrease over time

- Stripe: 2-day standard payout schedule for US accounts, with options for instant payouts (additional fee applies)

Geographic availability

Your location matters. Stripe wins the global race with coverage in 47 countries, while WooCommerce Payments serves 18. For physical stores, WooCommerce Payments only works in the US and Canada, but Stripe Terminal operates in 8 countries and counting.

Integration with your POS system

Running both online and physical stores? Your payment gateway needs to handle both seamlessly. Here’s how these platforms manage POS integration:

WooCommerce Payments offers native integration with your online store but comes with limitations for physical sales. While it works smoothly within the WordPress dashboard, its POS support is restricted to the US and Canada, potentially limiting your ability to expand.

Stripe shines with Stripe Terminal, their dedicated POS solution. It works with multiple POS systems, including Jovvie, supports a wider range of hardware, and operates in more countries. The system uses affordable card readers (around $60) and processes in-person payments through the same dashboard as your online transactions.

Both options integrate with WooCommerce through extensions, but Stripe’s broader compatibility with third-party POS systems gives merchants more flexibility for in-person sales.

Supported currencies

Both platforms support 135+ currencies, but there are differences in how they handle currency conversion:

- WooCommerce Payments requires separate accounts for different currencies

- Stripe offers more flexible currency handling with automatic conversion

Customer service

When payment issues arise, you need support fast. Here’s how these platforms have your back:

Stripe leads with comprehensive 24/7 support across email, phone, and chat channels. Their extensive documentation and active developer community mean answers are always at hand. WooCommerce Payments offers email support and some phone coverage, integrated directly through your WooCommerce dashboard – simpler, but less extensive.

User ratings

Real merchants’ experiences tell the true story. Here’s a look at the ratings for each:

- WooCommerce Payments:

- Average rating: 3.7/5

- Praised for native integration

- Some concerns about account stability

- Stripe:

- Average rating: 3.6/5

- Highly rated for reliability

- Praised for developer tools

- Some users note complexity for basic needs

Woo Payments vs. Stripe: Which is best?

Choosing between WooCommerce Payments and alternatives like Stripe comes down to your business’s specific needs. Here’s your clear path forward:

Choose WooCommerce Payments if you:

- Want the simplest possible setup with native WooCommerce integration.

- Operate primarily in the US or Canada for in-person sales.

- Prefer managing everything directly from your WordPress dashboard.

- Need basic, straightforward payment processing.

Go with Stripe if you:

- Require comprehensive 24/7 support.

- Plan to sell internationally or expand to new markets.

- Need flexible POS options across multiple locations.

- Want faster access to your funds.

- Process high transaction volumes.

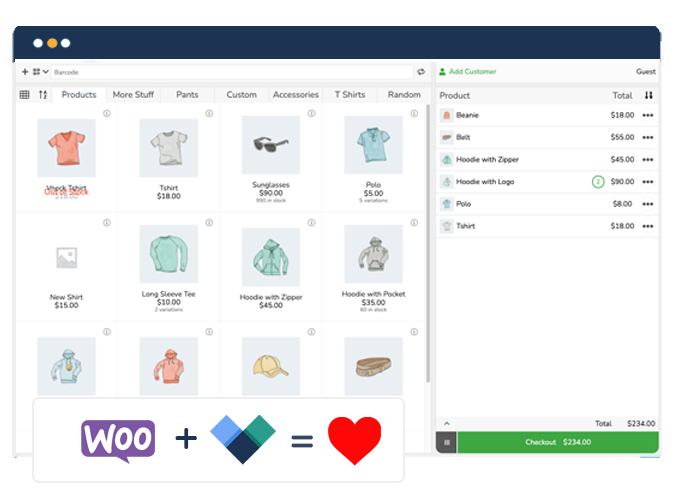

Make payment processing easy with Jovvie and Stripe Terminal

Both Stripe and Woo Payments offer secure, reliable payment processing, and either can serve as a solid foundation for your ecommerce business. For the best results with Stripe, consider pairing it with Jovvie POS. As an official Stripe partner, Jovvie seamlessly integrates with Stripe Terminal while offering advanced features like:

- Real-time inventory synchronization between online and physical stores.

- Flexible device compatibility (works on iOS, Android, and any browser).

- Built-in barcode scanning capabilities.

- Automatic receipt printing through BizPrint integration.

- No additional transaction fees.

Ready to optimize your payment system? Start with a free 30-day trial of Jovvie and experience how a properly integrated POS system can transform your payment processing, whether you’re selling online, in-person, or both.